Inside the mind of today’s bank customer: Consumer survey insights

If you're curious about how your banking style compares to that of other Americans, you're in the right place. Here, SoFi shares the results of its survey of 500 U.S. banking clients ages 18 and over, conducted in April 2024, and see how your habits in terms of savings, checking account balances, AI adoption, and more, measure up. You can also gain important insights about how to make your cash work even harder for you.

Key findings

Almost 4 out of 10 people monitor their money daily. Prepare for more surprises as you check out these highlights of SoFi’s How People Bank Today survey.

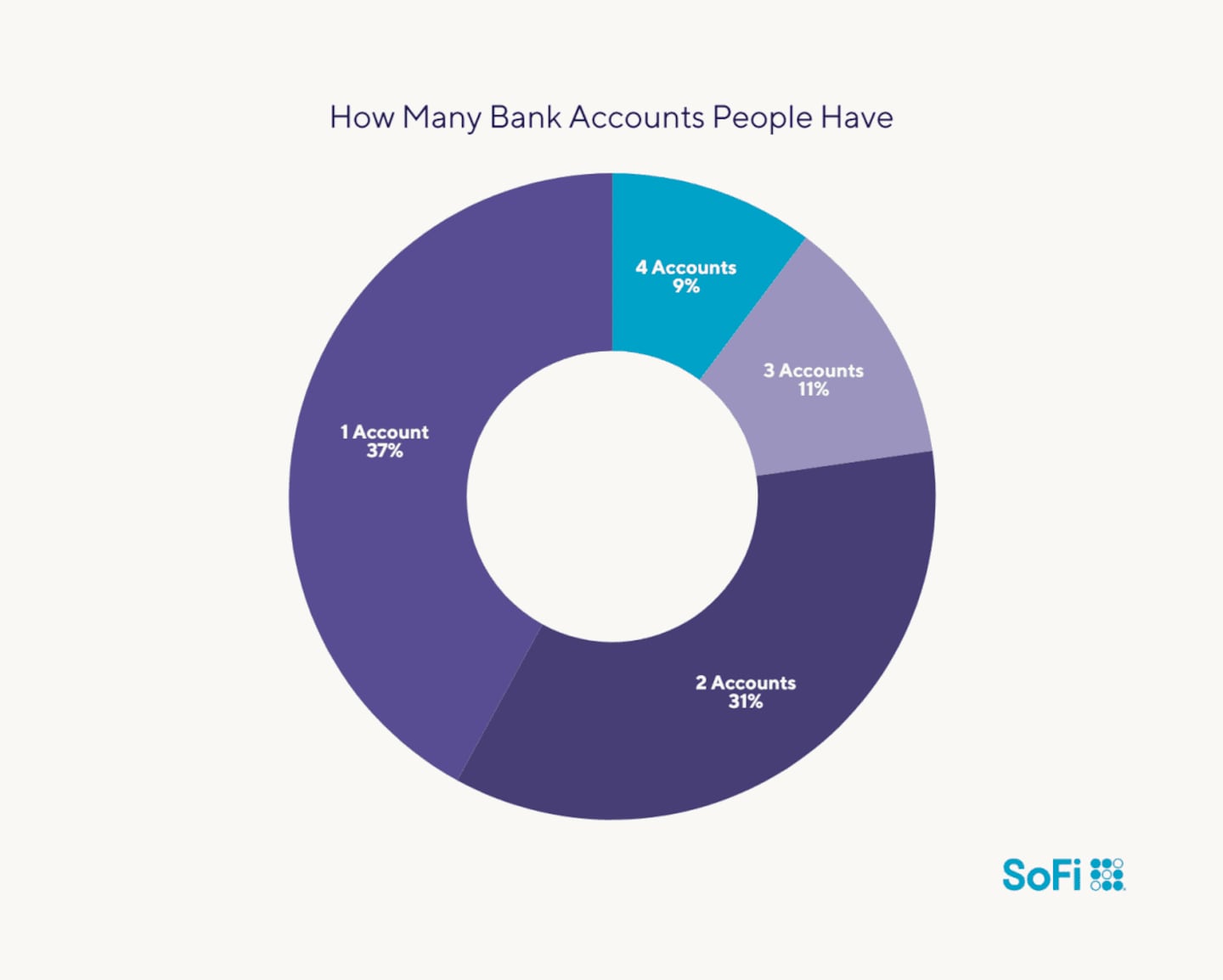

- 68% of respondents report having either one or two checking or savings accounts, including those of which they are joint owners.

- Of those with at least one account, 77% said they used their savings account for emergencies.

- 45% have less than $500 set aside for an emergency fund.

- 31% deposit money in their accounts (including direct deposit) a few times a month.

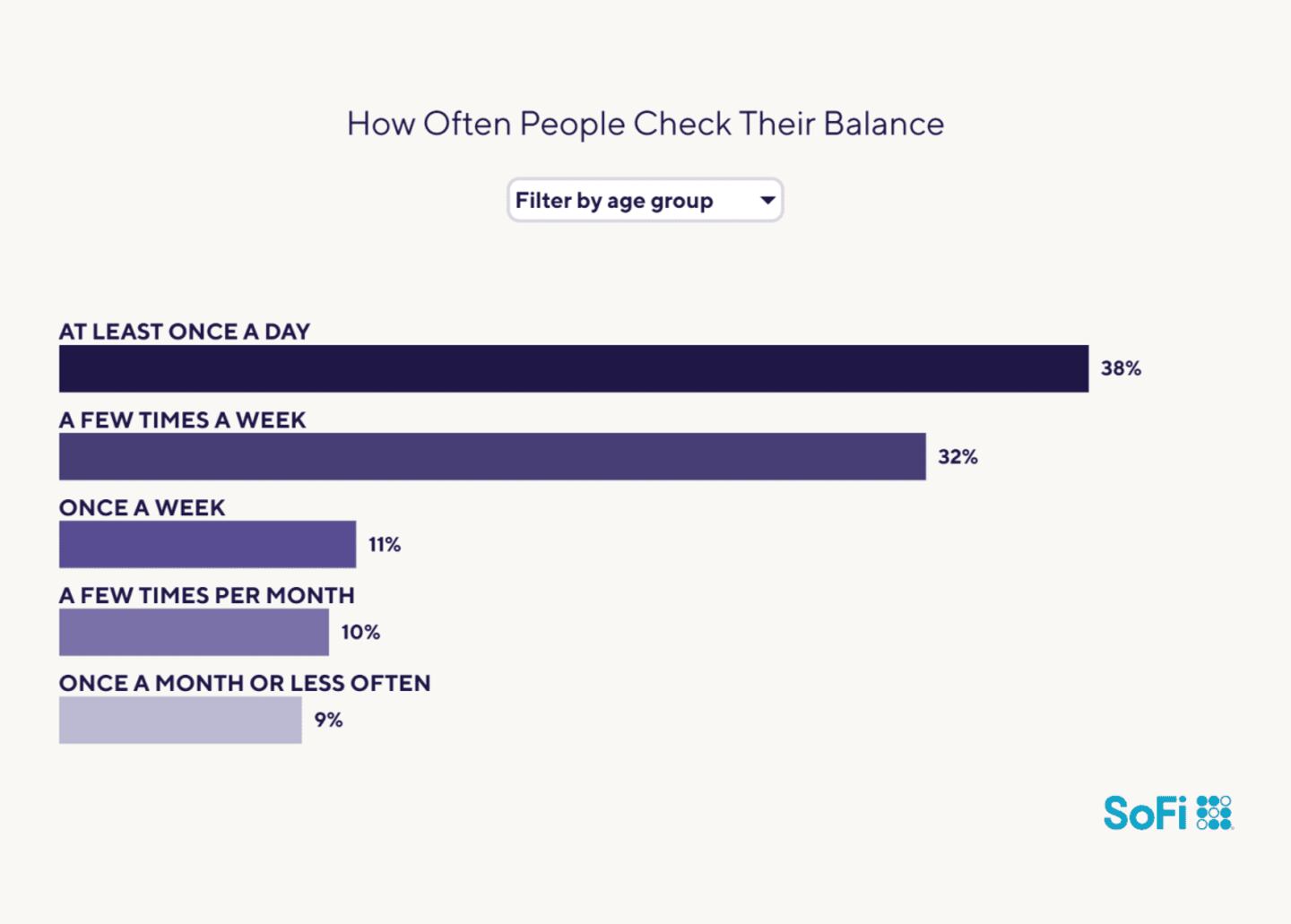

- 38% check their bank account balances daily, which can be more often than the typically advised pace for monitoring your bank account.

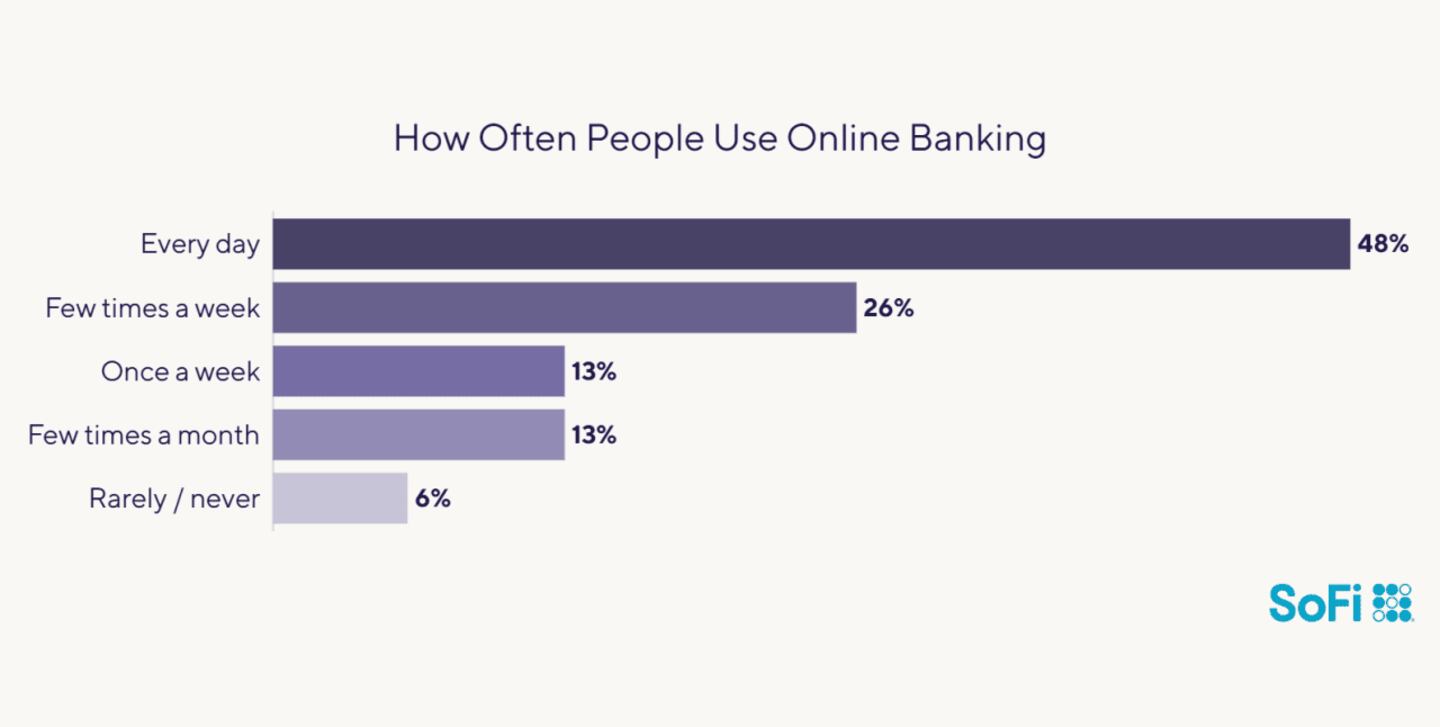

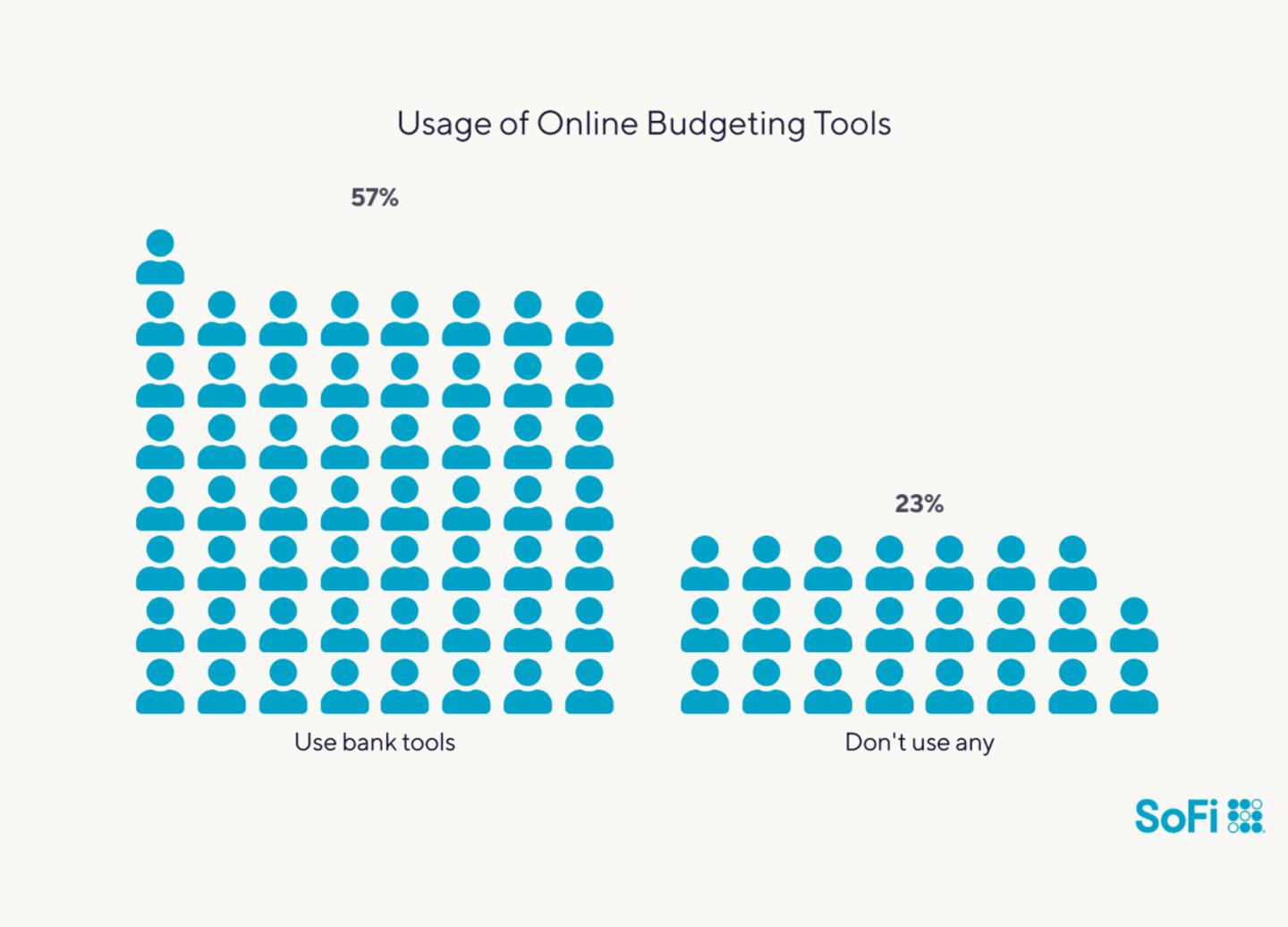

- 48% use online banking daily. Almost 1 in 4 (23%) use budgeting tools provided by their bank.

- 54% of those who have knowingly used AI-fueled tools when banking report doing so to track their credit score.

Banking habits and preferences

Many people have multiple bank accounts to manage, and they keep close tabs on their funds, SoFi’s data shows. They also know the importance of savings, especially for emergencies. So how much money do they have in their accounts? And how often do they make deposits? The How People Bank Today survey has the answers.

SoFi

68% hold 1 to 2 checking or savings accounts

Of the survey takers, two-thirds had one or two checking or savings accounts. Specifically, 37% had one, and 31% had two. These results may include joint accounts that they co-hold with another person.

Beyond that, 11% said they had three checking or savings accounts, and 9% had four. That means 1 in 5 people could be wrangling three or more accounts. While that may seem as if it's a lot to manage, there can be a benefit to having multiple bank accounts. For instance, if you have a side hustle, you might want your earnings and expenses to be funneled through a dedicated checking account.

Of people with at least one account, 88% had a checking account, and 71% held a savings account.

In terms of savings accounts, you might want to have one for your emergency fund, one for savings for a down payment on a house, and one for money you’re accumulating for that trip to Africa you’ve been dreaming of. Keeping each separate can help you track your cash and see how your balance in each one is growing.

Tip: Look for a high-yield savings account to get a favorable interest rate; online banks typically offer these with low (or no) fees.

Most use savings for emergencies, but nearly half have $500 or less

Having an emergency savings account is typically considered a critical element of financial stability. Many financial professionals advise having at least three to six months’ worth of basic living expenses in the bank. Your emergency fund could be tapped when a major medical, dental, or car repair bill unexpectedly hits, or if you were to lose your job and needed to cover your daily expenses.

However, according to SoFi’s survey, most people are falling short of the standard emergency fund goal. The data revealed that of those with an emergency fund:

SoFi

One way to grow an emergency fund can be to set up recurring automatic transfers between bank accounts, with money flowing on payday from checking into savings. Even if you only move, say, $25 per pay period, that’s a solid step toward building a cash cushion.

Wondering how much you should put toward your emergency fund? An online emergency fund calculator can help you do the math.

31% deposit money a few times a month

How frequently do most people deposit money into their account? Given the prevalence of direct deposit (about 92% of Americans are paid that way, according to PayrollOrg), many people make deposits on payday, which is often twice a month.

But in this era of the gig economy, with people commonly having multiple income streams, it seems that cash goes into bank accounts more often than you might expect.

SoFi

82% of people check their bank balances weekly or more

Technology, including ATMs, banking apps and websites, certainly makes it easier to keep tabs on your money, and many people are doing just that. Here’s how often survey respondents are taking a peek at their bank account balances.

SoFi

The right amount of monitoring will vary with an individual’s needs. Those who are actively saving toward a goal, like accumulating enough cash for a down payment on a property, may want to check in more often than someone who, say, bought a house a few years ago.

Most people visit a bank branch monthly

Some people bank at traditional rather than online banks, but digital-only banks have made considerable inroads in recent years. One key difference involves accessing physical branches, since online banks don't have any, which may enable them to reduce fees and offer higher interest rates.

SoFi was curious about how often bank branch visits occur. The survey revealed that 27% of respondents say they visit a physical bank branch once a month, 21% said they visit multiple times monthly, 23% visit rarely, 18% visit a few times annually, and 10% say they never visit a branch since their bank doesn’t have any.

SoFi

The role of technology in banking

The times in which we live and ever-advancing technology are changing the way people bank. SoFi’s survey uncovered these surprising findings about the role of automation, cybersecurity, and AI.

48% use online banking daily for balances, transfers, and deposits

Almost half (48%) of survey takers said they typically use online banking every single day, whether to check their balance, transfer funds, or make a deposit (with the convenience of mobile deposit). Talk about staying on top of your finances!

Another 26% said they usually bank online a few times a week, 7% said they access these services once a week, and 13% said they did so a few times a month. That leaves 6% who said they rarely or never used online banking services.

SoFi

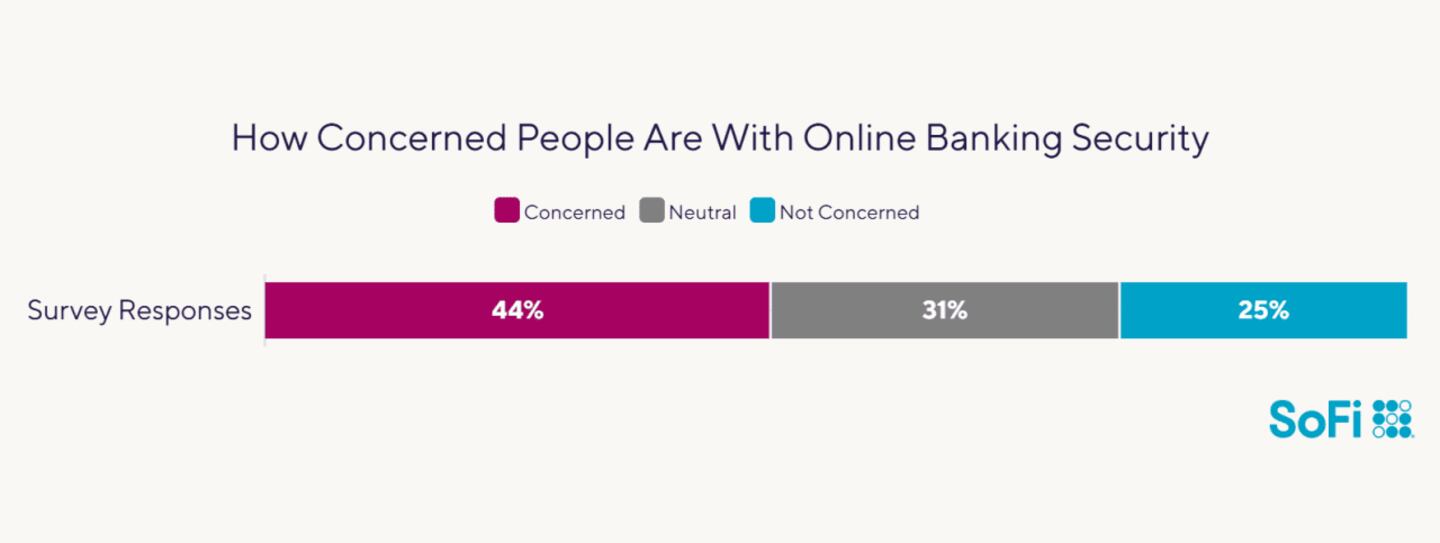

42% express worry about online banking security

Online and in-app banking appeal to many people for their convenience and other benefits, but some people have concerns, as well. When it comes to online banking, one of the biggest concerns is security, with 42% of SoFi survey participants worrying about this facet. Rounding out the responses, 29% described themselves as neutral about safety risks, and another 29% said they weren’t worried by this aspect of online banking.

SoFi

Typically, online or mobile banking is safe, but it can be wise to practice such habits as not replying to text messages or emails alleging there is a problem with your bank account, and not clicking on any links within those messages. Instead, consider going to your financial institution's website (or phoning customer service) directly to see if an issue has cropped up. Also, avoid accessing public Wi-Fi for online banking, and only use unique, strong passwords for your accounts as well as multifactor identification to help protect your money and avoid identity theft.

Most people skip budgeting apps, but 23% use their bank’s tool

There are many different types of budgeting methods out there, and digital money management tools are continuing to evolve to meet individual needs. Granted, 57% of survey participants disclosed that they don't use budgeting apps, but of those who do, 23% utilize tools provided by their bank.

SoFi

Often, these budgeting trackers and tools can be integrated in a way that makes monitoring and tweaking one's financial habits simple and seamless. It can be a good first step for those wanting to see where their money goes. There are also an array of third-party apps available.

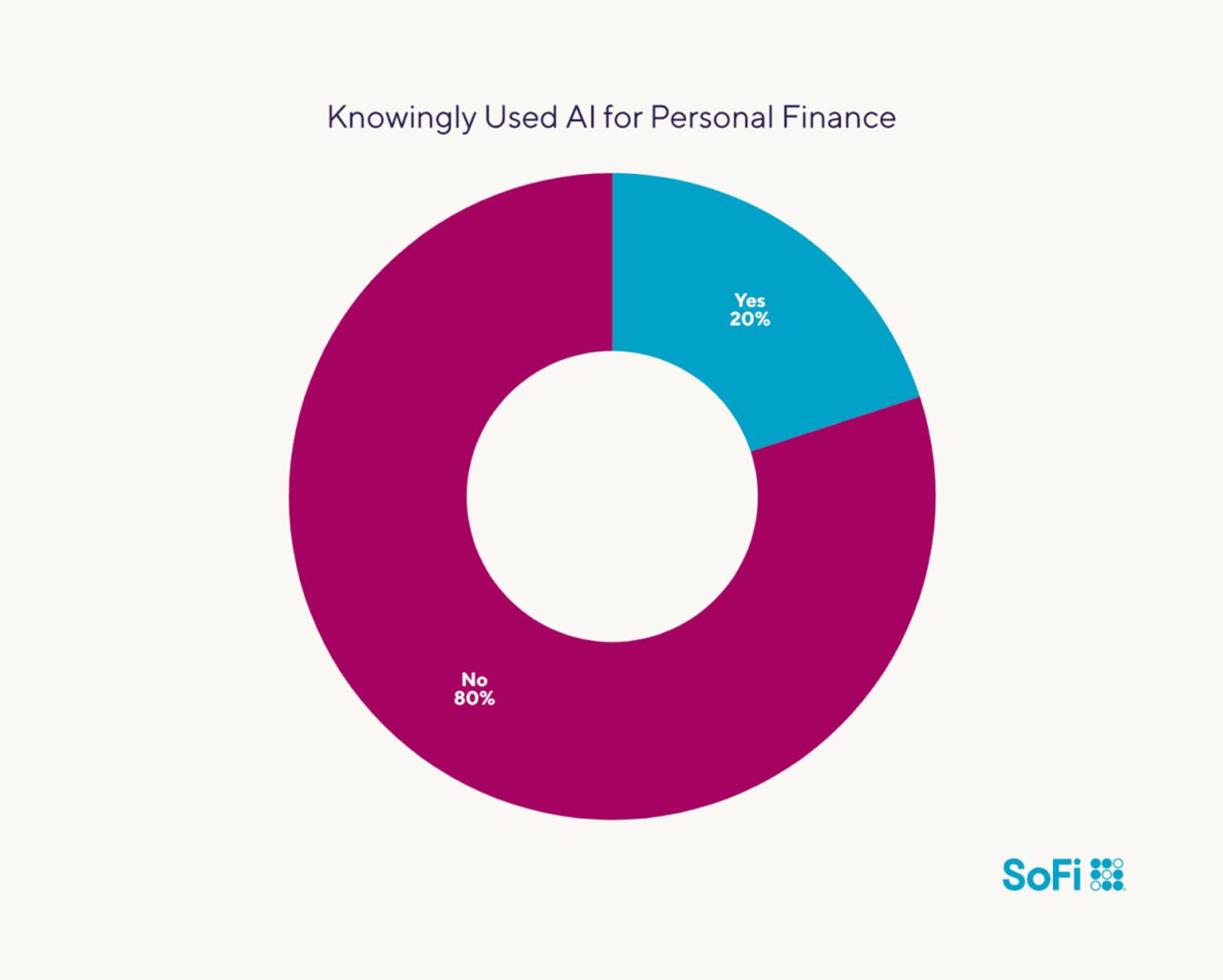

80% haven’t used AI for personal finance

SoFi

Artificial intelligence is making inroads into the way people bank today and tomorrow through such advances as automation and customization.

That said, 80% of SoFi’s survey respondents indicated that they hadn’t knowingly used AI for personal finance. Of the 2 out of 10 people who have used it, here’s how they tapped the power of AI.

SoFi

Switching banks and top features customers want

Sometimes, people need to switch banks to find a better fit. It’s a competitive field, and each individual’s personal finance needs are unique. Here’s what the SoFi survey discovered consumers are seeking from their banking partner.

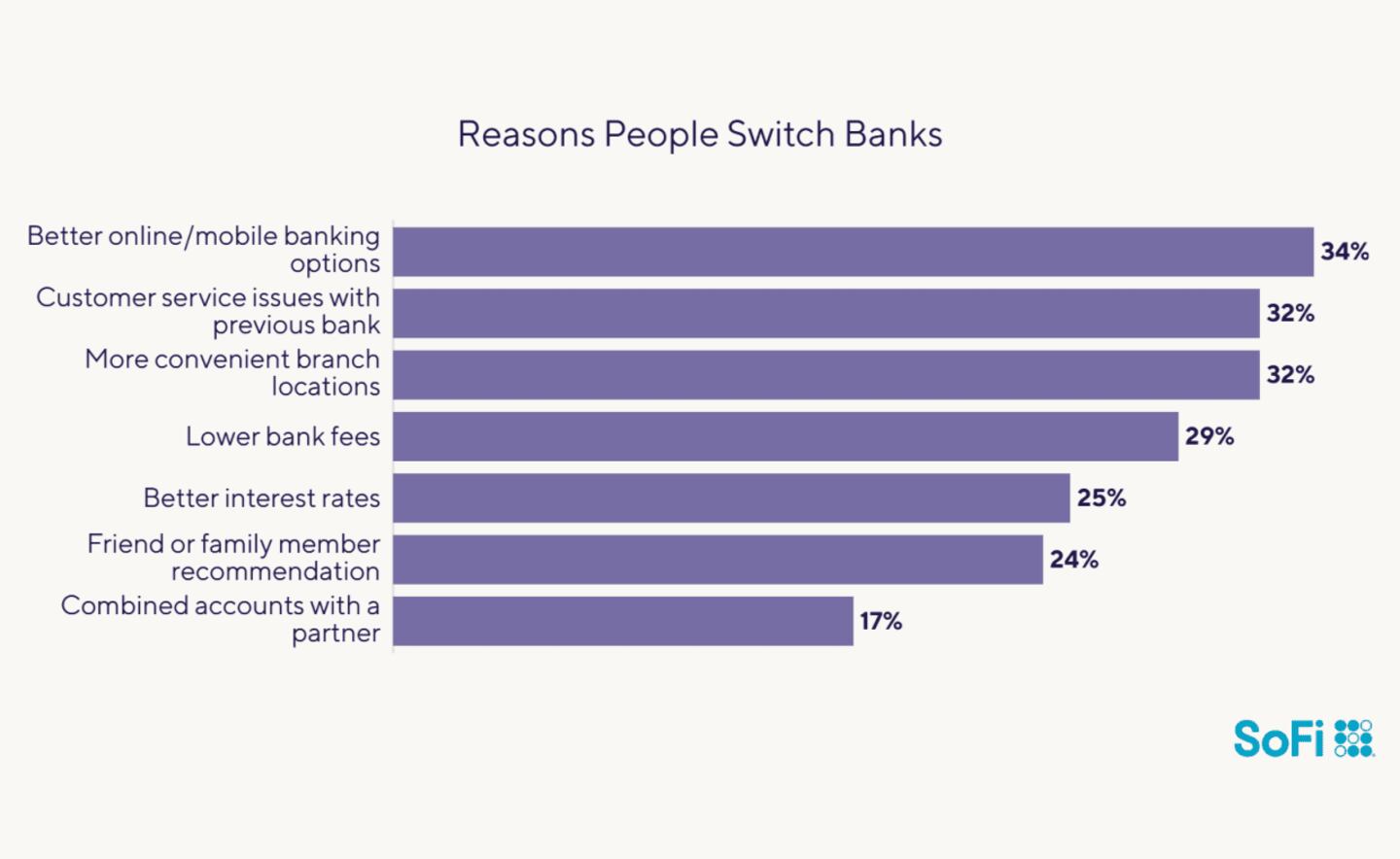

Better online banking drives 34% of bank switchers

More than half (55%) of the survey respondents said they had switched banks in the past. What drove them to uproot their accounts? The reasons are quite varied.

SoFi

Monthly fees and overdraft protection were the top checking account features

It may be no surprise that fee-free services are a main draw for people when choosing a bank. Some of the top features respondents look for when choosing a checking account include no monthly fees (66%), low minimum balance requirements (45%), and ATM fee reimbursements (38%). In addition, 57% of respondents said overdraft protection is an important feature in a checking account.

SoFi

The takeaway

The way people bank today is undergoing some fundamental changes. According to key findings from SoFi’s survey of 500 respondents ages 18 and older, 2 out of 3 people have one or two checking or savings accounts, and 77% use their savings account for an emergency fund. However, many have $500 or less in the bank.

Habits are shifting as well. Customer visits to bank branches often only occur once a month, while tech adoption — online and mobile banking and, increasingly, AI-powered tools — is growing.

This story was produced by SoFi and reviewed and distributed by Stacker.